Economic growth has flatlined so far this year, raising concerns among analysts and policymakers alike. Despite the optimism that often accompanies a new year, the economic indicators suggest a stagnation that could have long-lasting implications. This lack of growth is particularly alarming in the context of a post-pandemic recovery, where many had anticipated a robust rebound fueled by pent-up consumer demand and government stimulus. However, as businesses struggle to gain momentum and consumer spending shows signs of tapering off, the prospect of a vibrant economic landscape appears increasingly distant. The flatlining of economic growth not only affects businesses and investors but also impacts employment rates and wage growth, creating a ripple effect throughout the economy.

Adding to the uncertainty is the recent uptick in inflation, which has emerged as a significant concern for consumers and economists alike. Rising prices for essential goods and services are squeezing household budgets, leading to heightened anxiety about financial stability. Inflationary pressures have been exacerbated by supply chain disruptions, labor shortages, and increased production costs, all of which have contributed to the rising cost of living. As consumers watch their purchasing power diminish, their confidence in the economy is shaken, prompting a more cautious approach to spending. This shift in consumer behavior can further stifle economic growth, as reduced spending leads to lower demand for goods and services, creating a cycle that is difficult to break.

Consumer sentiment is also reflecting these economic challenges, with many individuals expecting the situation to worsen in the months ahead. Surveys indicate that a growing number of consumers are bracing for more significant economic difficulties, including the possibility of recession. This pessimistic outlook can have a self-fulfilling effect, as consumers may choose to hold back on spending in anticipation of tougher times, thereby contributing to the very downturn they fear. Businesses, too, are taking note of these sentiments, with many adjusting their forecasts and strategies in response to consumer expectations. The interplay between consumer confidence and economic performance is critical; as fear and uncertainty grow, so too does the likelihood of reduced economic activity.

The implications of this economic landscape are significant not only for Wall Street but for policymakers as well. Investors are closely monitoring these trends, as they can influence stock market performance and the overall investment climate. A stagnant economy accompanied by rising inflation poses a unique challenge for the Federal Reserve, which must balance the need for growth with the imperative to control inflation. As the central bank navigates these turbulent waters, its decisions will have far-reaching consequences for interest rates, credit availability, and overall economic stability. In the face of these challenges, effective communication and strategic planning will be essential in steering the economy back on a path toward growth and stability, ensuring that both businesses and consumers can weather the storm ahead.

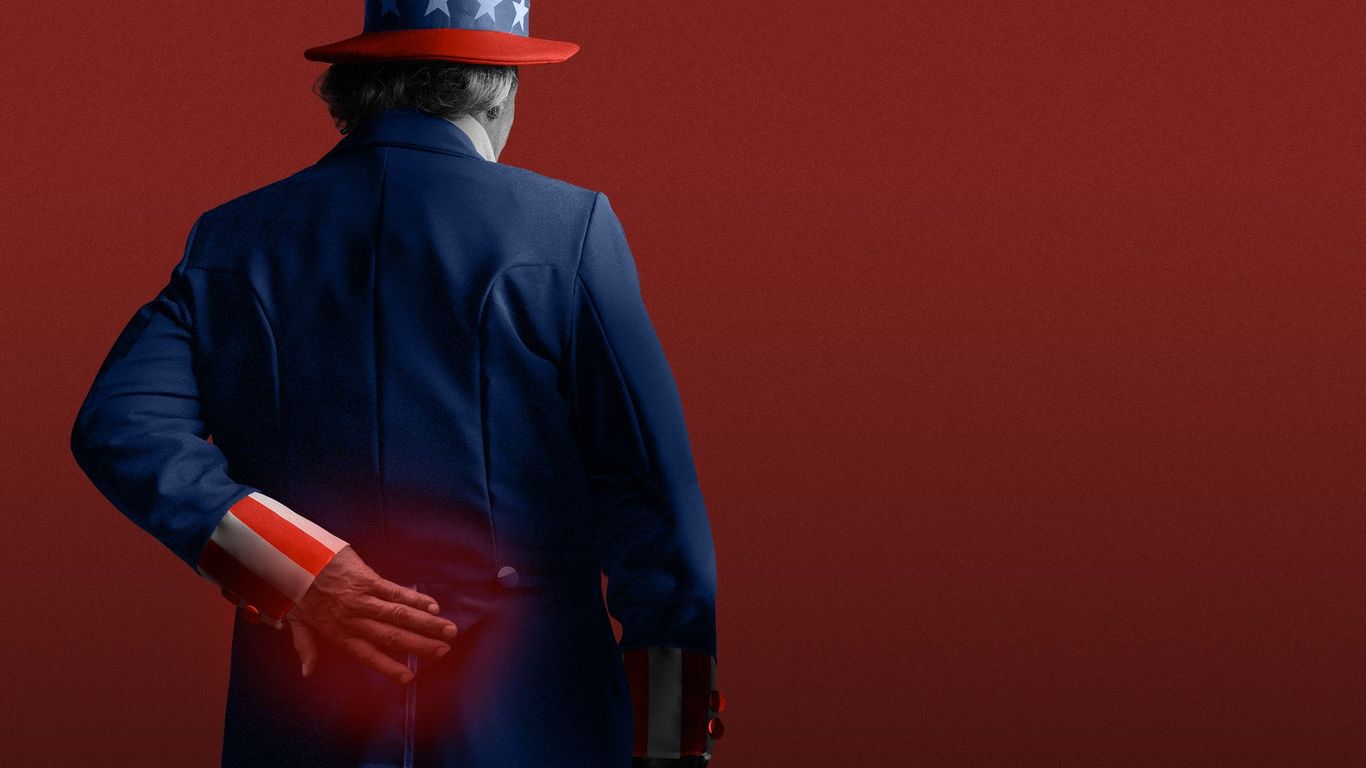

The s-word rippling through Wall Street and Main Street - Axios